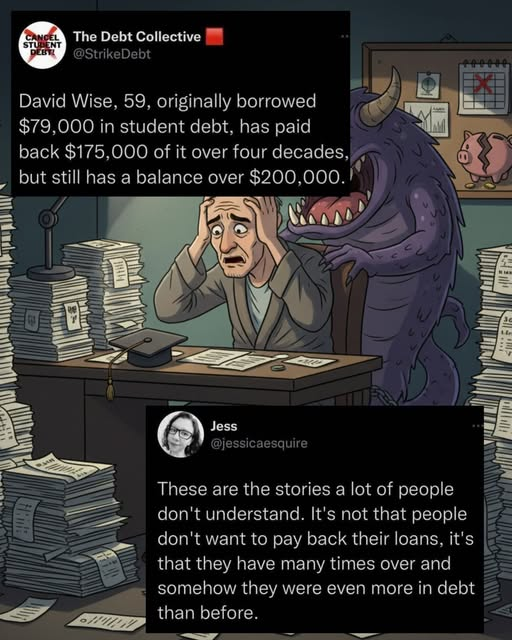

And here’s the original tweet:

Let’s throw some numbers on this…

First, I doubt he borrowed the $79 thousand up front. Instead that was probably how much he borrowed across 4 years. So from, I presume, about 1982 to 1986. Which really was one of the worst times to be borrowing money due to inflation.

I’ll also presume the loan was in deferment while he was in school, so interest was being assessed that entire time unless he was making payments to at least keep up with that.

Now back in the 1980s, the total amount you could borrow through the Stafford loan program – i.e., “Federal student loans” – was $2500 per year according to this article. Stafford loans have the benefit of a capped interest rate. They’re still variable rate loans, but they were capped at 8%. In the 80s, this meant the interest rate was less than inflation. But capped interest rate also meant limited borrowing.

Again, it was limited to only $2,500 per year. Yet on average, Dave was borrowing nearly $20 thousand per year. So that extra $17,000 per year he borrowed would’ve come from private lenders and was not Federally insured. Meaning Dave was borrowing at whatever interest rate the banks came up with. And it was likely a variable interest rate as well.

And if the loan was in deferment while he was still in school, he likely accumulated interest across his 4 years in school such that he, in effect, owed about 1.5x what he borrowed in total. So already he was in the 6-figures for student loan debt and he hadn’t even started paying it back.

And that was in the 1980s. Just the principal alone, adjusted for inflation, would be about $230 thousand today. Add in the interest, which likely would’ve been capitalized – meaning, rolled into the principal – when he entered repayment, and that’s the equivalent of $300 thousand today.

And yet, he was paying on average… from late-1986 into 2022, so about 35-1/2 years… about $400 per month. On 6-figures of student loan debt.

And in that time, he’s accumulated $121,000 in interest at a rate of about $285/mo. Meaning the total interest being assessed averaged, given his monthly payment, probably about $675 per month, meaning an average interest rate of about 10%.

To get out from under the loans would’ve required him… probably tripling his monthly payments. Doubling would’ve at least overtaken the interest being assessed and allowed the principal to reduce. But tripling his payments was really the only option to make substantial headway and get the loans paid off in a more reasonable timeframe.

He should also have tried refinancing the loans at the various times when interest rates were at their lowest.

You must be logged in to post a comment.