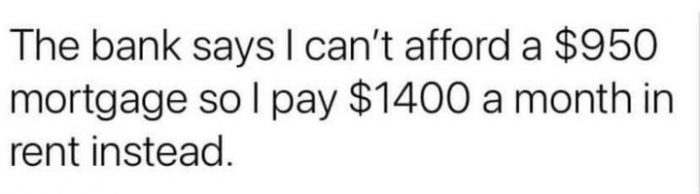

I’ve owned my home for about two (2) years now. Prior to that, I rented for a little over 14 years straight. Lately I’ve been seeing a lot of memes show up on social media similar to this one:

If your mortgage payment will be less than your rent payment, that should be an easy sell to the bank. Right? Not so fast.

The property owner is responsible for pretty much everything. And you can’t call up the property owner whenever there is a problem if the property owner is you. You have to take care of it. It’s your problem, meaning it’s also your cost.

In the first year I owned my house, I had to replace the garbage disposal and dishwasher. Just the out-of-pocket for both was about $1,000 combined. And if I’d paid someone to install both rather than doing it myself, it easily would’ve been double that.

Over the 4th of July weekend preceding the date on this article, my air conditioner died. While waiting for a diagnostic and repair, I had to throw down another $1200 for window and portable A/C units to keep the house somewhat reasonable. Thankfully my nearby Home Depot was open on 4th of July so I could pick those up. (Update: The refrigerant line had a leak, and I decided to replace the entire A/C system for several reasons, in part due to the age of the condensor/compressor unit.)

I’m also re-insulating the attic since it appears that has been done… never. With exception to what was over the two smaller bedrooms, that is. Mostly. Old insulation called Balsam wool that has been up there since… the house was built. Something I wish the inspector pointed out in their report. But once all that’s replaced, the amount of electricity and natural gas it’ll take to keep my house reasonably climate controlled should be much lower than before.

And there was also the bathroom exhaust fan that needed replaced as well as part of the re-insulation. Which gave me a chance to correct one issue pointed out on the inspection report regarding there not being an exhaust duct while also being able to install a very quiet unit of my choice.

My house was originally built in 1951. And I anticipated that there would be some things needing fixed up and some things that were done either half-assed or not at all. And I was okay with that. Because part of the appeal of buying a house is being able to personalize it.

That isn’t something you have a lot of flexibility to do when you’re renting. (Or living in a neighborhood with an HOA.) What you see is basically what you get. And if anything breaks, you pretty much have to wait on your landlord to either fix it or call in someone to do that. But you ultimately aren’t paying for it directly. (By the way, the risk of needing to do that is one of the reasons your rent is higher than a mortgage payment.)

But what matters to the bank is whether you can afford to be a home owner. And I don’t mean just the mortgage payment and utilities. I mean… everything else like what I’ve mentioned above. Replacements, repairs, home maintenance, etc. It’s all on you.

That is why the closing costs are so important. It’s one of the tests the lender has on whether you can afford to be a homeowner. It’s a red flag (or a complete no-go depending on other factors) if you have to borrow money from someone else to make the closing costs. When I put down the earnest money via a Postal Money Order, my lender asked where that money came from – i.e. they wanted to see the receipt.

And easily the biggest test is how much money you currently have in savings when you apply for the mortgage.

The risk with the lender is whether you can continue to afford being a homeowner, or will you fall behind if something with the house goes south? Or will you put off repairing what went south, provided you get it repaired at all, so you don’t fall behind on the mortgage? Falling behind on the mortgage and potentially sacrificing the value of the home to any kind of disrepair are risks to the lender. That is why lenders require adequate homeowner’s insurance.

The bank doesn’t really care what your current rent payment is versus where they calculate your mortgage payment since that doesn’t answer those questions. But your credit rating and how much you have in savings does answer those questions in one direction or another.

Since writing a mortgage is about more than whether you’re a good or bad lending risk. It’s also about whether you’ll be a good or bad homeowner.

You must be logged in to post a comment.