Fractional reserve banking. “Creating money out of thin air”. Debasing the currency. It can certainly be a confusing concept.

Banks we are told have the ability to create money “out of thin air”, and they do this through loans, thus keeping the actual money creation linked to an actual demand for that money. How this happens has received a lot of attention in recent years, with bank failures and other financial institutions faltering and going away in the wake of the financial crisis. But it’s an involved concept and one that can be difficult to understand, especially since many articles I’ve read that attempt to explain it don’t really go far enough.

To understand how fractional reserve banking actually works, we need to get into some accounting concepts. I’ll explain them as necessary along the way, so you don’t need to worry about me dumping a ton of definitions on you up front.

But one definition I do need to foist upon you is the accounting equation: Assets = Liabilities + Equity. This is the foundation for all accounting.

All accounts used in accounting fall under one of those three categories: assets, liabilities and equity. Most people are familiar with assets and liabilities, as your bank account is an asset, and so is cash in your hand. Loans and credit cards are liabilities, as is any outstanding balance you might have with a utility company or your doctor’s office. It can get a little more complicated from there, so I’ll try to keep it simple.

And in that vein, let’s start with something with which I’m sure most of us are familiar: demand deposit accounts.

Demand deposit accounts

Whenever a bank agrees to open an account in your name, the bank’s books will reflect that account as a liability – i.e. the bank basically owes you the entire amount you have deposited minus any agreed-upon fees. Demand deposit accounts, such as checking accounts, are so named because you can walk into the bank and demand any or all of the balance of your account at any time. And with ATMs and online banking, it really can be practically any time you can access your funds.

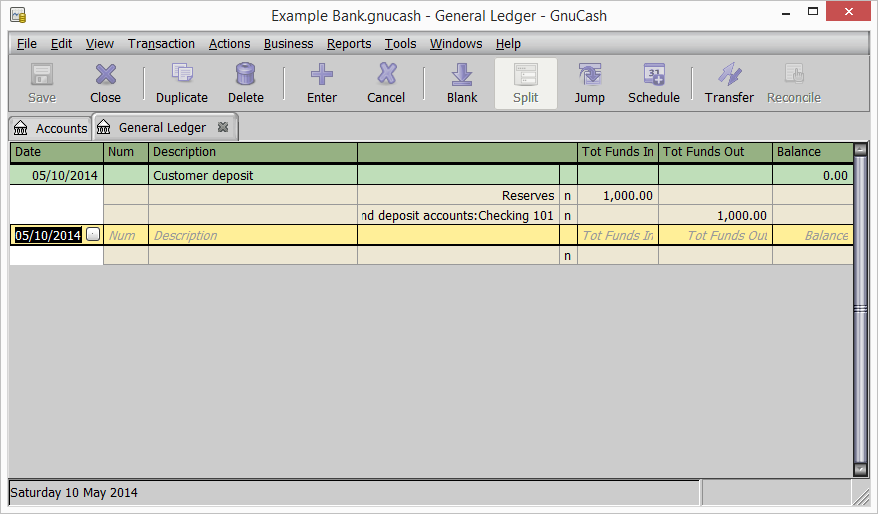

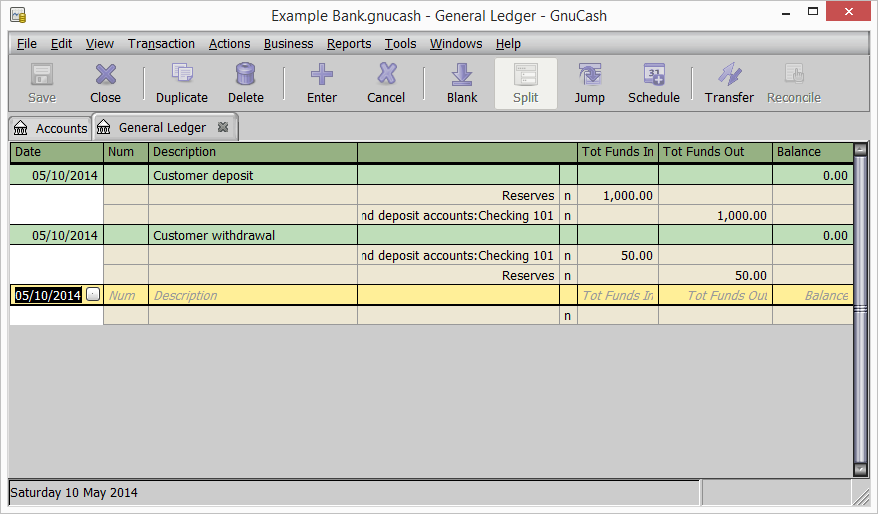

When you deposit your paycheck into the bank, the bank will take that amount and add it to their reserves (assets) and credit your account (liabilities) the same amount:

When you withdraw money from your account, there is a reduction in the bank’s reserves for the same amount you withdraw:

Pretty simple, right? And it’s something everyone can readily see and understand. When you put your money in a bank, you are trusting that money to the bank that the money will be available when you need it. With regard to the accounting equation, everything stays balanced: the bank’s assets (reserves) are equal to their liabilities.

Now normally when you deposit a check with your bank, the amount is not immediately available because there is a clearance process. Cash is the only kind of deposit that immediately credits a bank’s reserves, and thus is immediately available for withdrawal by a customer.

Loans

Here’s a question: when a bank loans out cash, from where do you think they are getting the money to loan out? If you answered they’re using their own resources, you’re partly correct. In reality, banks loan out the money their customers deposit with them.

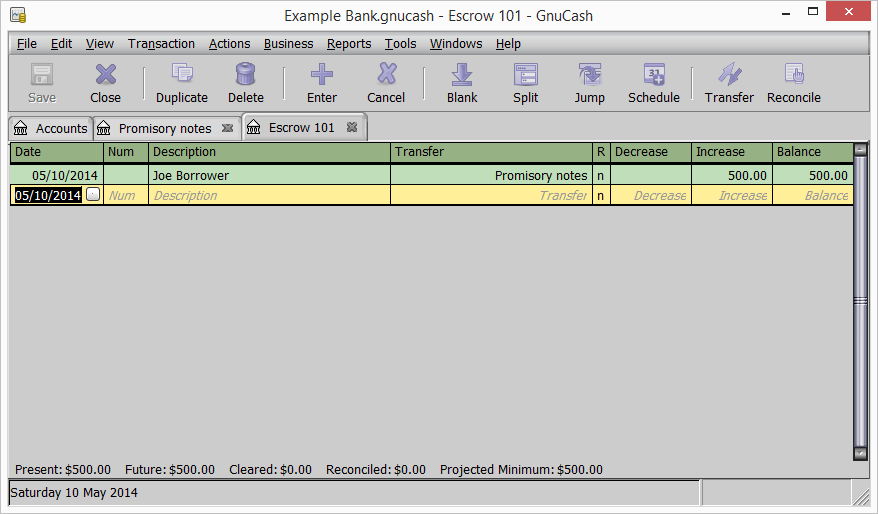

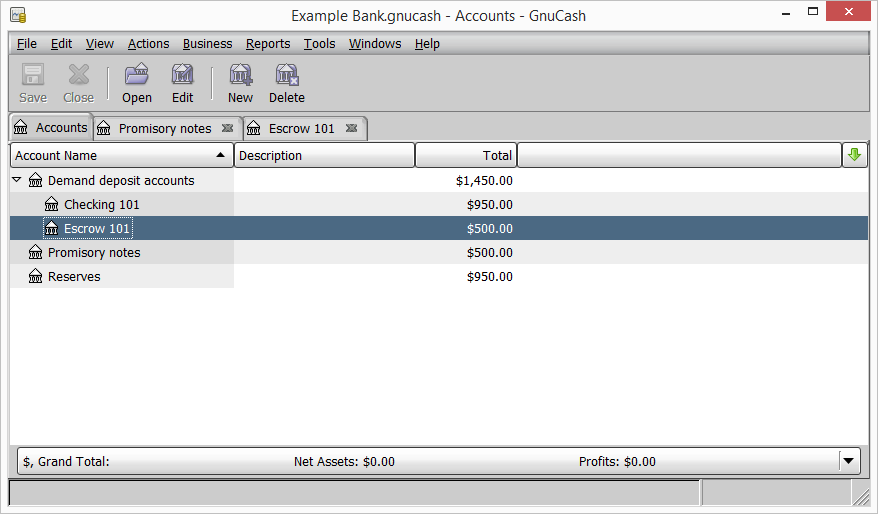

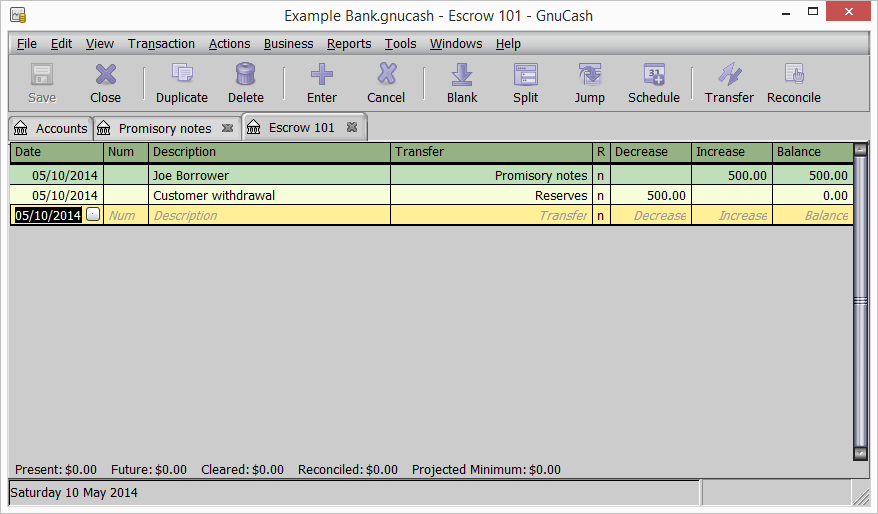

When you take out a loan, you sign a “promissory note“, which is a promise to pay back to the bank the particular amount borrowed. That note is an asset to a bank, but not in the same way as the reserves because it is not cash. Instead it is a different kind of asset called a “receivable“. When you sign a note with the bank, the bank will make a credit to a deposit account (typically called an “escrow account”) for the same amount:

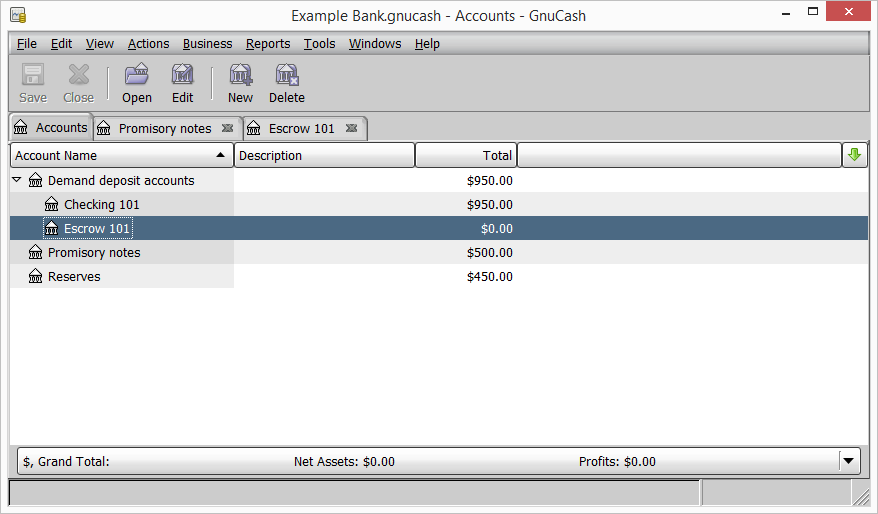

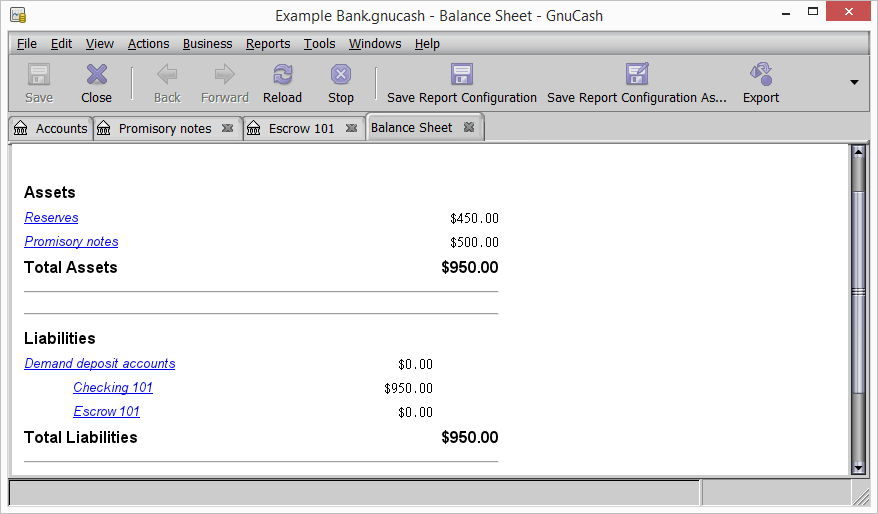

By taking the note and making a credit to a demand deposit account, the bank now has total liabilities that exceed its reserves: $1,450 in liabilities in its demand deposit accounts, but only $950 in actual reserves. This is the essence of fractional reserve banking.

Now typically what will happen is the person who takes out the loan will deposit those loan funds into a different bank, or the money will be taken away from the lending bank through withdrawals by the customer borrowing the funds. This causes the principal to be deducted from the bank’s reserves:

All money that leaves a bank does so through a deduction from the bank’s total reserves. But the bank still has total assets in line with its liabilities:

Now the total amount a bank can lend out is dependent upon what is called a reserve requirement, which for most banks in the US is 10%. On the banks books, the balance of the Notes Receivable account plus the balance of the Reserves must be no more than 10x the balance of the reserves. Few banks will get to that level, though, simply because of the risk involved. Remember our example bank still has a liability of $950, but only $450 in reserves backing it. If they loan out too much, they risk becoming insolvent.

Now what if the money is given by the borrower to a customer of the same bank? In that case, ultimately only the liabilities are changed: the $500 account liability is shifted from one account to another. Reserves are, in the end, unchanged, but the total liabilities on the bank still increase, and the bank still ends up with liabilities in excess of reserves.

Money creation

The common and popular assertion is that banks create money by writing loans. Not only is this not true, there is no way to demonstrate it to be true through any kind of legitimate accounting.

In all accounting, increasing one asset must decrease another asset – such as when moving money between accounts or withdrawing from an account to cash – or increase your liabilities or net equity. A promissory note is an asset to the bank called a “receivable”. The transaction that creates the loan account must be coupled with a transaction that decreases the bank’s assets or increases the bank’s equity or its liabilities.

Equity accounts include revenue accounts. The statement that money is created whenever a bank writes a loan cannot be true even if you say the promissory note is revenue to the bank – meaning creating the promissory note account is coupled by crediting the revenue account. This is nonsensical in numerous ways. First, there is again no money created because all disbursements of loan funds come out of a bank’s cash holdings – i.e. the reserves. Plus a promissory note is not revenue to the bank just as it is not revenue to any other organization that might issue a loan. Whether it is a bank that accepts the promissory note or another organization, the accounting is the same: the journal entry coupled with creating the promissory note account must be either to credit an escrow account or deduct (credit) another asset – again this would be the bank’s cash holdings – i.e. their reserves.

The Federal Reserve has even said in “Modern Money Mechanics” that banks exchange promissory notes for credits to a deposit account. This means the bank is trading a liability on the borrower – the promissory note – for a liability on itself – the escrow account.

Those who claim that private banks create money by writing loans are basically asserting that accepting the promissory note increases two asset accounts in the same transaction – reserves and receivables – or that withdrawing the loan funds from the escrow doesn’t change the reserves – a debit from one account without a corresponding credit to another. Nothing in any accepted accounting principles allows for this. And before you try to assert that banks don’t use the same accounting principles as everyone else, you’d better have citations at the ready.

A bank that writes a loan accepts liabilities in excess of its reserves, again the essence of fractional-reserve banking. When a borrower withdraws the loan funds from the bank that wrote the loan, the bank’s assets are necessarily decreased by that transaction, again as already demonstrated above.

As such the idea of the “money multiplier” is based on a fallacious understanding of how loans work and the accounting behind it, because money is not being multiplied through loans. Instead only liabilities on the banks are being multiplied. If you want to discover the fallacy behind this quite quickly, ask anyone who asserts that “private banks create money through loans” what happens when the borrower withdraws the loan funds.

The only entity within our banking system that has the ability to create new money “out of thin air” is the Federal Reserve. But it doesn’t just do so whenever it feels like it. All of its money creation is linked to government bonds. It creates new money by buying government bonds from the open market, and by making short-term loans to banks at the discount rate through promissory notes secured by allowable collateral specified in the Federal Reserve Act.

In other words, a significant portion of the money supply is tied directly to the borrowing authority of the United States government. This is why inflation is a constant in the money supply – the Federal Reserve has even admitted that they aim for a consistent inflation rate of 2% – along with an ever-increasing national debt that cannot be paid down without shrinking the money supply.

But one thing that must be pointed out is that the Federal government cannot sell bonds directly to the Federal Reserve. Instead those bonds must first be sold to private individuals or entities, from whom the Federal Reserve may purchase them.

So how exactly is money created?

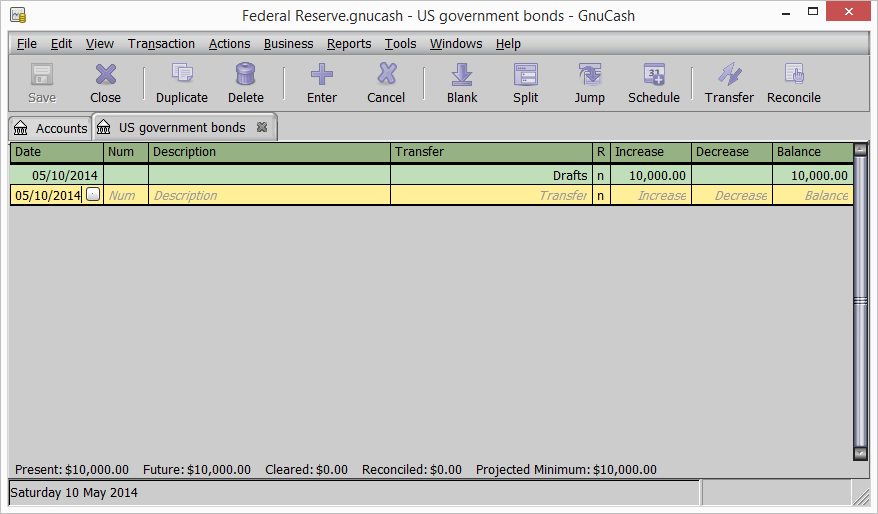

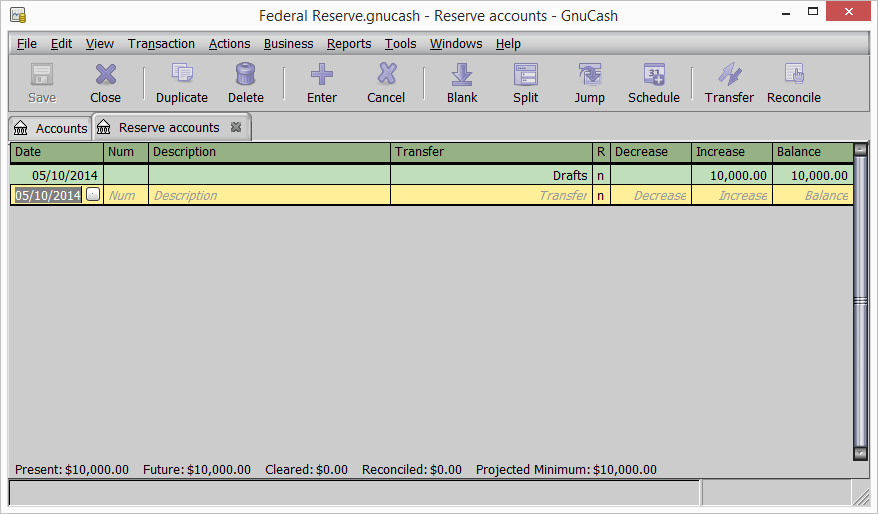

When a person sells their government bonds to the Federal Reserve through the open market, the Federal Reserve issues a financial instrument in exchange for the securities. This action has not yet created new money because the only thing that has happened is a financial instrument has been traded for another. So in our example, let’s say the Federal Reserve purchased a $10,000 bond from someone:

When any entity buys a bond from an issuing authority, they are loaning money to that issuing authority and receiving an asset in exchange. Like promissory notes, bonds are a receivable to the bond holder. Bonds can be traded between entities, and when the Federal Reserve purchases the bond from a bond holder, they are receiving an asset as well, and the bond’s face value is credited to a receivables account. But the Federal Reserve doesn’t have any cash assets it can trade for the bond, so it issues a liability instrument of its own called a draft.

A draft is a financial instrument that most people know as a “check”, which is formally known as a “bank draft”. This draft is actually a liability to the Federal Reserve. The person holding the Federal Reserve financial instrument will take that to a bank for deposit (most likely), adding to the bank’s liabilities but not yet to its reserves because only cash can immediately credit a bank’s reserves. Instead the bank will make on its books a credit to their Federal Reserve reserve account:

As part of the normal processing of financial instruments, that instrument will make its way back to the Federal Reserve, who will then credit the value of the instrument to the bank’s reserve account at the Federal Reserve.

The reserve is now new money that can be withdrawn by the customer or loaned out by the bank that accepted the Federal Reserve financial instrument for deposit. This is what is known as “monetizing debt”. Just as banks take promissory notes (debt obligations) and turn them into credits to demand deposit accounts, the Federal Reserve takes bonds (debt obligations) and turns them into credits to demand deposit accounts – the reserve accounts for the various member banks.

And the Federal Reserve is the only organization in the United States legally able to do this kind of bookkeeping magic.

The Federal Reserve being the central bank is what allows all of that bookkeeping magic to work. When money is withdrawn from one bank and deposited in another, the Federal Reserve will deduct from one liability account and credit another. So all of the money in our monetary system basically moves from one liability account to another, whether it is by transfers between the reserve accounts of different banks or being withdrawn as bank notes.

But all of this only happens on the borrowing authority of the United States government. This means that if all debts were paid off, including the national debt, there would not be a single dollar in circulation, because the Federal Reserve would have no assets to balance its own liabilities to the member banks and the Federal Reserve Notes.

There’s also nothing inherently unconstitutional about this. But the fact that money is literally created out of thin air simply because the United States Treasury issues a bond that the Federal Reserve then “purchases” should be concerning as there is literally nothing backing the economy of the United States except the promise of the Federal government as proxy of the taxpayers to pay back the debt.

And then there’s the application of interest.

Money can only be created by the Federal Reserve when it buys a bond created by the United States government. When the government issues a bond, it is agreeing to pay back the face value of the bond plus accrued interest. But the Federal Reserve will only create enough money to cover the principle value of the bond.

So if the Federal government creates a 1-year bond for $10,000 with even a 1% interest rate, it owes $10,100 to the person who buys the bond. If the Federal Reserve purchases the bond, it will create only $10,000 in new money from that bond. So from where will the other $100 come? The Treasury will have to create another bond to borrow more money to cover its previous bond and the interest it owes on it.

This is the classic debt cycle of borrowing to cover existing debts, as the Federal government must continue borrowing money so the Federal Reserve can keep creating money only so the Federal government has money to pay on its outstanding obligations, while continually refinancing those bonds to avoid having to repay the principal on them.

That is why the national debt is continually growing with no end in sight and likely no end possible. And that is also why inflation is a constant in our economy.

Bank insolvency and the 2008 financial crisis

In evaluating how banks operate under fractional reserve banking, it should be easy to see how this can lead to insolvency. But what keeps banks from becoming insolvent when they’re lending out deposited funds that could be withdrawn at any time? That would be the overnight lending market.

Basically the way this works is banks try to anticipate the financial demands of their customers. If they have enough reserves on hand to fulfill those demands plus maintain their reserve requirement, then all is well. If they need cash, they can borrow it from other banks through the overnight market. The Federal Reserve district banks, such as the one here in Kansas City, also help facilitate the overnight markets, especially given the vast majority of transactions now occur electronically. The overnight market is what keeps liquidity flowing through the system so banks can continue to meet their liabilities.

Along with this, banks take on investors of their own, issuing financial instruments to entice people to loan money to the bank. These include certificates of deposit, money market and other investment accounts. These build up a reserve that allow a bank to make loans to individuals or meet liabilities. Typically these financial instruments pay interest to the purchaser, which comes out of the interest the bank charges to borrowers. This is also the reason these financial instruments have penalties for early withdrawal.

But these financial instruments are still liabilities on the bank. There is just a hard contract preventing immediate redemption of the deposit.

Banks can also adjust their lending activity based on the behaviors of their depositors. If those who purchase the financial instruments are more likely to roll them over – that is, purchase a new financial instrument with a matured financial instrument – then the bank can afford to be a little looser in its lending. If the instruments are more likely to be cashed out at maturity, the bank will be quite conservative on its lending to ensure it has cash on hand to cover the matured instruments.

As discussed earlier, when a bank lends money to a borrower, it increases its liabilities while not increasing its reserves. When the funds for the loan are deposited at another bank, the originating bank’s reserves are depleted while its liabilities are untouched, allowing a bank to have, as an example, $5 million in reserves against $20 million in outstanding liabilities. If the original depositor comes in to make a withdrawal, the bank may need to borrow money on the overnight market to satisfy the withdrawal, depending on what they have on hand.

As the loan is paid back, the bank’s reserves are increased and the funds are used to shore up their liabilities for when CDs and other financial instruments mature. As an option, a bank may also sell off a loan to another party, recovering some of the principal in the process, also allowing the bank to shore up its liabilities or make new loans.

All of this is needed to accommodate the maturity of these financial instruments.

And all of this works only so long as the borrowers pay back their loans and defaults are uncommon. In a healthy economy, that is the case. When defaults occur, banks can typically recover something. In the case of mortgages, the bank gets a house, which it can then typically sell to recover a good chunk of the principal, and sometimes the entirety depending on how far into the mortgage term the borrower was before foreclosure.

So given this, it should be obvious what occurs when you combine a lot of defaults and foreclosures with a crashing housing market: banks become unable to make their own liabilities, thus risking insolvency. This will cause a bank to freeze credit and do everything they can to rein in as much of their outstanding receivables as possible, including selling off what they can.

If banks could create money out of thin air merely by writing a loan, no bank would be at risk of insolvency.

Bonds and Mortgage-backed securities

A bond is a debt security. An investor who buys a bond hands over a corresponding amount of money to the issuer equivalent to the face value of the security. The bond promises the investor periodic interest payments and a return of the bond’s face value once it has matured. This differs from a note which divides the maturity value of the note into equal-sized periodic payments. With a bond, it is the interest that is divided into equal-sized payments and the principal is returned as a lump sum at maturity.

As an example, let’s say we have a $10,000 bond with a 10-year maturity at 3% interest per year. The total interest of the bond is calculated using the simple interest equation: I = PRT, where P is the principle ($10,000), R is the annual interest rate (.03), and T is the maturity time of the bond (10). So the interest on the bond is $3,000. This means that over the course of the 10 years, the bond holder will receive total interest payments of $3,000, or $300 per year, and at maturity he can cash out the bond and get his $10,000 back, or he can use the matured bond to buy a new one.

Note: With some bonds no interest is paid to the bond holder until maturity when the bond holder is entitled to the principal and accumulated interest. In this vein, some bonds have a set maturity value, and the buyer pays a reduced amount – i.e. purchasing a $1,000 bond for $750, with the $1,000 value being the matured value of the bond at a particular date.

So how do these mortgage backed securities work, then?

Well, the idea is simple. An investor buys the bond and hands over the corresponding face value. The interest on the bond comes from the mortgage payments. Now typically the bonds are not such that it’s one bond per mortgage, but several bonds per mortgage. For example, a $100,000 mortgage could be divided into 100 bonds with a face value of $1,000 each, or 10 bonds with a face value of $10,000, or whatever configuration they want to make that falls within the expected future value of the notes.

Typically the mortgages are pooled together with the maturity value of the bonds being a slice of the total future value of the pool – it just makes managing things a little easier. The actual full details of how one of these was managed is certainly a bit more complicated than how I portrayed it here, but that’s the general abstract of how it worked.

Now the principal and interest on the bonds are secured by the payments from the borrowers on all the mortgages. But the amount coming in from the payments is going to be significantly more than the interest payments going out, meaning that in a good economy this should be a pretty safe way of operating things. Even with the periodic risk of a foreclosure, a sound and stable housing market means the note holder should be able to sell the house and recuperate a good portion of the remaining balance at the time of foreclosure. A good portion of bonds are also rolled-over, that is a matured bond is used to buy a new bond instead of being cashed out.

So again, all of this hinges on people actually paying their mortgages and a modest instead of over-saturated housing market.

But done right, a lot of people have the potential to make a lot of money. Because with the principal from bonds shoring up reserves, and the interest on the bonds being small compared to the mortgage payments, lenders have the ability to repeat the cycle. The principal on the bonds funds new loans, more bonds are sold backed by those loans… lather, rinse and repeat again.

As long obligations and promises were being kept, no one really cared how it all worked.

But again, all of that hinges on people making their payments. If foreclosures start piling up, suddenly there are a lot of houses to sell, and the oversaturation on the supply curve of the housing market means prices drop through the floor. Everything just cascades from there.

The pool becomes unable to make interest payments on their bonds. Lenders now have less reserves and risk insolvency. Some actually become insolvent and are bailed out, while others fall prey to the Federal Deposit Insurance Corporation (FDIC). Things go from bad to worse very quickly, and we end up in Q4-2008.

And all this time, you probably thought it was President Bush’s fault.